inheritance tax rate indiana

The inheritance tax was repealed. In 2020 there is an estate tax exemption of.

Another State Death Tax Kicks The Bucket Will More Fall

However the inheritance tax was an issue for those transferring large amounts of.

. However be sure you remember to file the. Web State inheritance tax rates range from 1 up to 16. Web 13 rows There is also a tax called the inheritance tax.

Inheritance tax applies to assets after. Web Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. The Probate Process In.

Indiana has a three class inheritance tax system and the exemptions. In Maryland the tax is only levied if the estates total value is more than. Web The Iowa tax only applies to inheritances resulting from estates worth more than 25000.

Indiana used to impose an inheritance tax. Web INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS IC 6-41-3 Chapter 3. Spouse Children Grandchildren Parents Effective July 1 1997 the first 10000000 of an estate going to an heir in Class A is exempt of inheritance tax.

So no inheritance tax returns Form IH-6 for Indiana residents for Form IH-12 for non-residents have to be prepared or filed. Tax rates can change from one year to the next. Web The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. In 2021 the credit will be 90 and the tax phases out. Web Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess.

The act was amended in 1915 1917and 1919. Web Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Web Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

Web In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. In 2021 the credit will be 90 and the tax phases out. Web For most decedents estates there was no or very little Indiana inheritance tax.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana State Tax Guide Kiplinger

Death And Taxes Nebraska S Inheritance Tax

Federal And State Guide For Inheritance Tax Smartasset

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

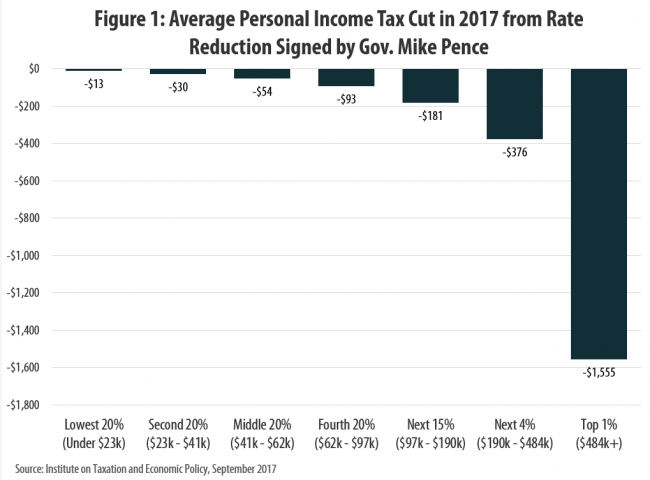

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep

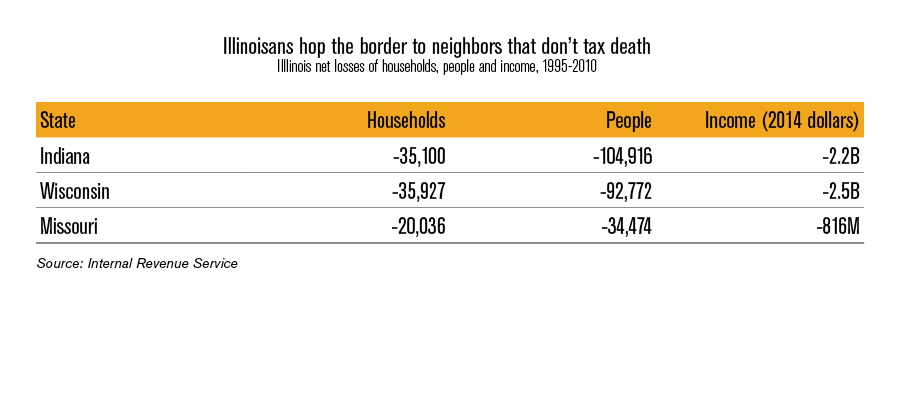

New York S Death Tax The Case For Killing It Empire Center For Public Policy

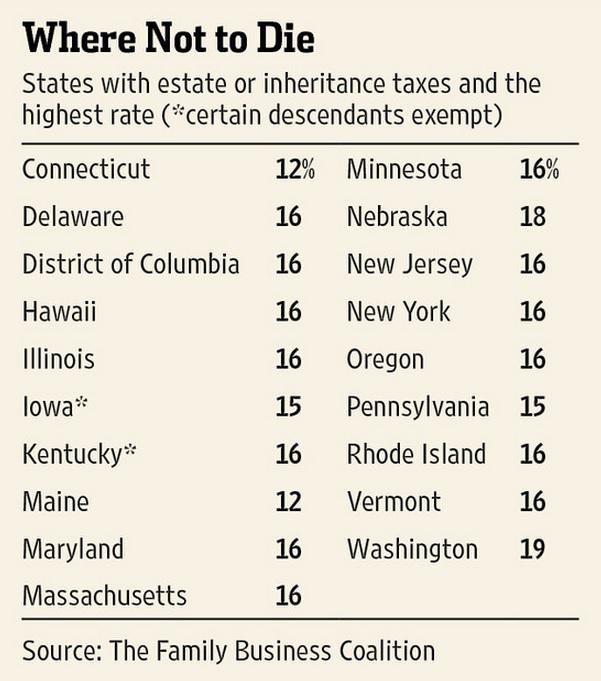

State Estate And Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Dor Unemployment Compensation State Taxes

State Estate And Inheritance Taxes Itep

Top Five Strategies For Avoiding Estate Taxes Infographic Indianapolis Estate Planning Attorneys

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council

Estate And Inheritance Taxes Around The World Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Estate Tax Rates Forms For 2022 State By State Table

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)

.png)